Asset Focus

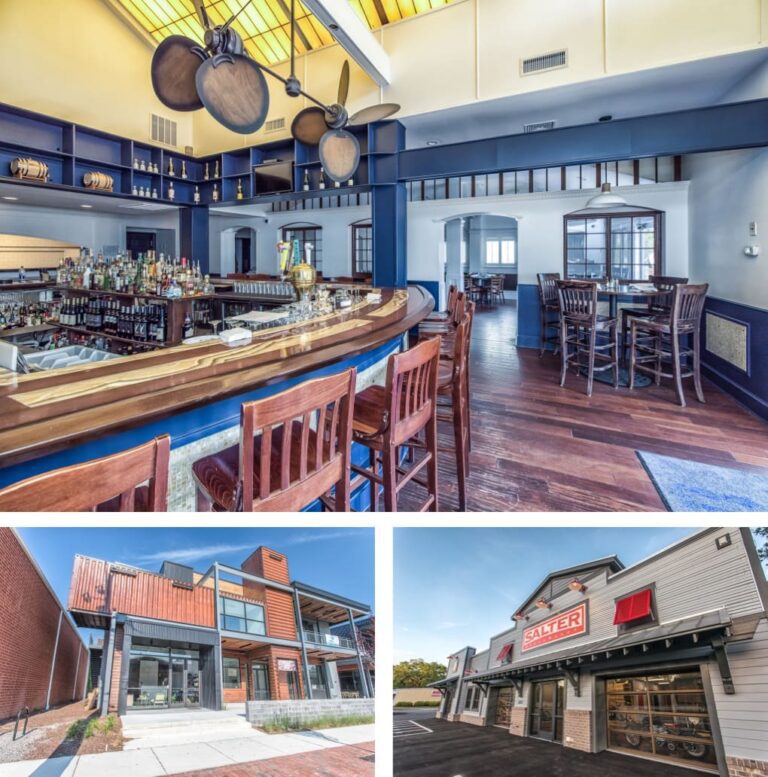

Our primary investment focus is on Retail, Medical Office, and Industrial asset classes in the North and South Carolina.

Timeless Capital Investment identifies, acquires, develops and manages non-residential commercial real estate that meet our stringent standards. By owning the entire process and leveraging our commercial development corporation, Timeless Properties Construction Co Inc, we are able to minimize overhead, hold to strict timelines and adapt to changing market conditions while maintaining the highest quality. Our tight market focus and experience in the market gives us a significant advantage in the markets we pursue.

Acquisitions

What are we searching for?

With a primary focus is on retail, office and industrial asset classes in the Southeastern United States, we are continuously looking for properties:

- In well established areas, busy intersections, high volume traffic, growing areas and beautiful climates.

- Near major transportation, airports, employment centers densely populated area or pockets with growing employment or new business expansion

- 1-10 million dollar shopping centers with a minimum of 40,000 square feet underperforming or in need of major repair.

- Raw land in areas ripe for development that we will find highest and best use for.

How it Works

Become an Investor

Investors partner with Timeless Capital Investments on new development, redevelopment, and value add opportunities in North and South Carolina.

Select an Opportunity

We will match you with projects that meet your risk tolerance and timeline for anticipated returns.

Invest in Property

We leverage our 17 years in commercial construction when selecting the right commercial buildings and development opportunities in markets we know and trust.

Receive the Earnings

Investors receive quarterly distributions tied to cash flow. The cashflow can vary based on the investment type and plan for creating the anticipated returns. Distressed or Development is a longer timeframe with higher anticipated return. Value add on an underperforming asset should be shorter timeframe with more modest returns.

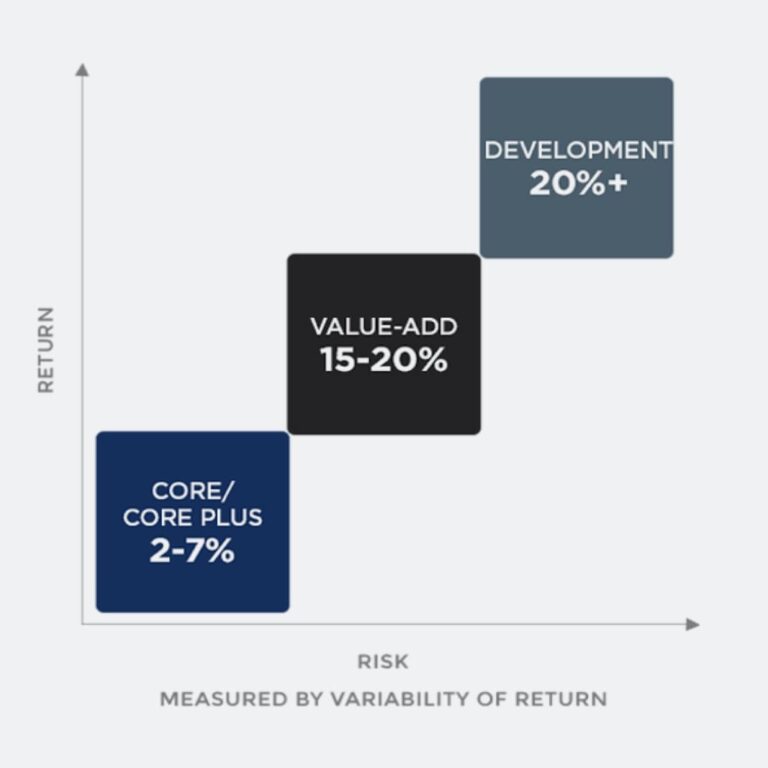

Which Model Fits Your Financial Goals and Risk Tolerance?

Projected Cash Flow or Long Term Return

Value-Add

- Improving B and C Class Non Residential Commercial Real Estate

- 40% of return from Income / 60% from Sale

- Highest Level of Cash Flow and Flexibility

- Modest Speculation

- Modest Returns

Development

- Building new or salvaging D Class Properties

- 10% of return from Income / 90% from Sale

- Most Speculative

- Highest Potential Return

Class A Existing Called Core/Core Plus (Not something we pursue)

- Holding A Class Units with Stabilized Income

- 70% of return from Income / 30% from Sale

- Least Flexible

- Lowest Speculation

- Lowest Return (Compared to a bond)

Lets Discuss Your Financial Goals

It all depends on your risk tolerance and timeframe for returns

Value add or Distressed. Measure your tolerance. Our value add and distressed opportunities focus on Retail, Industrial, and Medical Office in North and South Carolina. Our construction experience gives us a tremendous amount of industry experience and knowledge on how to increase the presence and value of existing commercial assets.

What we don't pursue Existing Class A Properties

- New Construction or recently remodeled

- Top Amenities

- High-income tenants

- Great location

- Little or no deferred maintenance issues

Value Add Opportunities consist of Class B or C Properties

- Properties that have higher vacancy

- Deferred maintenance issues

- Older properties that have not recently been remodeled

- Located in great locations with historical performance

- Mixture of tenants including Local small businesses tied to the community

Distressed Property Opportunities

- Older properties with high vacancies or completely vacant

- Needs infrastructure improvements

- Require significant or immediate repairs on roofs, parking lots, façade, design including structural repairs ect.

- Located in older areas of town in need of revitalization.

- Opportunity to be part of bettering communities and making the area a better place to work and live.

Cashflow

Operations

Once we have fully implemented our plan. Positive cash flow from rental income is typically distributed to investors quarterly and in lump sum payouts at disposition and/or refinancing. This timeframe can vary significantly depending on the project.

Value Add Quickest Distributions

Distressed Modest Timeframe for Distributions

Development Long hold period with lump sum Distributions

Appreciation

Lease up or Completion

Unlike residential or multifamily syndication, our business plan focuses on business to business transactions. We force appreciation in assets by updating and improving the property then leasing it up with professional management. The property is valued primarily on its Net Operating Income (NOI), not property comps. Through physical and operational improvements, we will increase the value of the property by increasing NOI.

Amortization

Equity

Revenue from regular operations & rental income pays down the debt on the property, which in turn builds equity for our investors.

Depreciation

Tax Benefits

Investors benefit from tax benefits such as accelerated depreciation and cost segregations, possible 1021 exchanges into new projects and tax-free return of initial equity.